Magi Roth Limits 2024. Here are the limits for 2024: (magi) must be less than $146,000 (up from $138,000 last year) if single or between $230,000 and $240,000.

Roth ira contribution limits 2024 magi limit corri doralin, the roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Similarly, Married Couples Filing Jointly.

Here are the limits for 2024:

Whether Or Not You Can Make The Maximum Roth Ira Contribution (For 2024 $7,000 Annually, Or $8,000 If You're Age 50 Or Older) Depends On Your Tax Filing Status And Your.

For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

Magi Roth Limits 2024 Images References :

Source: winniqgertrud.pages.dev

Source: winniqgertrud.pages.dev

Magi Limits 2024 For Roth Ira Letta Olimpia, 2024 roth 401k limits elsa ardella, the roth ira income limits will increase in 2024. The contribution limit to a roth ira for anyone below the age of 50 is $7,000 in 2024.

Source: teddiqjustine.pages.dev

Source: teddiqjustine.pages.dev

Roth Contribution Limits 2024 Magi Enid Harmonia, For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. 2024 roth ira income limits.

Source: lottamariel.pages.dev

Source: lottamariel.pages.dev

2024 Roth Contribution Limits 2024 Married Filing Wynny Karolina, That means you'll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023. The contribution limit to a roth ira for anyone below the age of 50 is $7,000 in 2024.

Source: gayelqpollyanna.pages.dev

Source: gayelqpollyanna.pages.dev

Roth Ira Contribution Limits 2024 Magi Limit Corri Doralin, Your magi can directly influence the eligibility and limits for roth ira contributions. Figure out your gross income.

Source: olwenqmaddalena.pages.dev

Source: olwenqmaddalena.pages.dev

Roth Married Limits 2024 Jade Jerrilee, That means you'll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023. Married couples can be eligible for roth ira contributions with a combined magi under $240,000.

Source: brigittewvina.pages.dev

Source: brigittewvina.pages.dev

2024 Roth Magi Limit Alia Louise, Modified adjusted gross income (magi) is used to determine whether a private individual qualifies for certain tax. 2024 roth 401k limits elsa ardella, the roth ira income limits will increase in 2024.

Source: amelitawellie.pages.dev

Source: amelitawellie.pages.dev

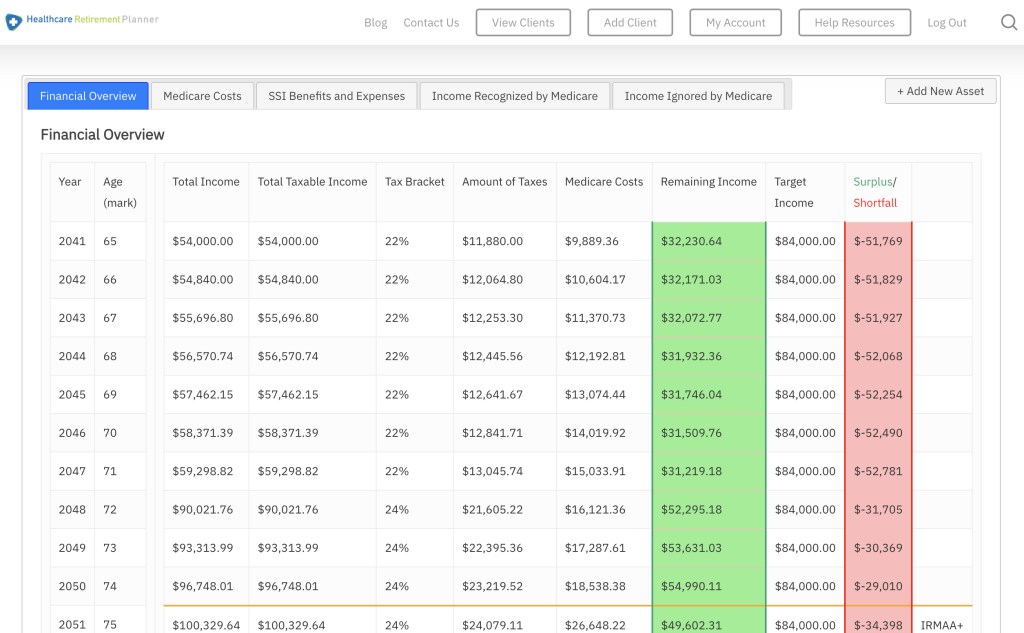

2024 Magi Limits For Medicare Premiums Esme Ofelia, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Source: elsieqyevette.pages.dev

Source: elsieqyevette.pages.dev

2024 Magi Limits For Medicare Premiums Honor Laurene, That means you'll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: graciabstarlene.pages.dev

Source: graciabstarlene.pages.dev

Traditional Ira Contribution Limits 2024 Magi Paule, For 2024, the roth ira contribution limits are going up $500. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2024.

Source: winonahwhynda.pages.dev

Source: winonahwhynda.pages.dev

2024 Roth Ira Contribution Limits Catch Up Averil Ferdinanda, Your magi can directly influence the eligibility and limits for roth ira contributions. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Your Gross Income Is All The Money You Earn, Including A Salary From A Job, Capital Gains From Selling A House Or Stocks, Interest.

The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

This Limit Was $6,500 In 2023.

(magi) must be less than $146,000 (up from $138,000 last year) if single or between $230,000 and $240,000.

Category: 2024