Colorado Tax 2024. Your household income, location, filing status and number of personal exemptions. The department of revenue is processing 2023 income tax returns.

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: In general, an employer must withhold colorado income tax from all wages paid to any employee who is a colorado resident, regardless of whether the employee performed.

The Deadline For Filing A Colorado State Tax Return Is April 15, 2024.

Colorado state income tax tables in 2024.

A Quick And Efficient Way To Compare Annual.

Colorado has state sales tax of 2.9% , and allows local governments to collect a local option sales tax of up.

You're Closer Than Ever Now That The Colorado Department Of Revenue Has Begun Processing Tax Forms For The 2023 Tax Year (Due In 2024).

Images References :

Source: www.motortrend.com

Source: www.motortrend.com

2024 Chevrolet Colorado Prices, Reviews, and Photos MotorTrend, Calculate your annual take home pay in 2024 (that’s your 2024 annual salary after tax), with the annual colorado salary calculator. Previously, colorado taxed income at a fixed rate of 4.55%, but the passage of.

Source: www.2024calendar.net

Source: www.2024calendar.net

Federal Pay Period Calendar 2024 2024 Calendar Printable, The salary tax calculator for colorado income tax calculations. Enter your details to estimate your salary after tax.

Source: janiczek.com

Source: janiczek.com

Colorado Tax Law Changes Already Passed To Keep in Mind in 2022 and, Democrats are set to unveil their colorado property tax relief plan this week. However, you must pay 90 percent of any.

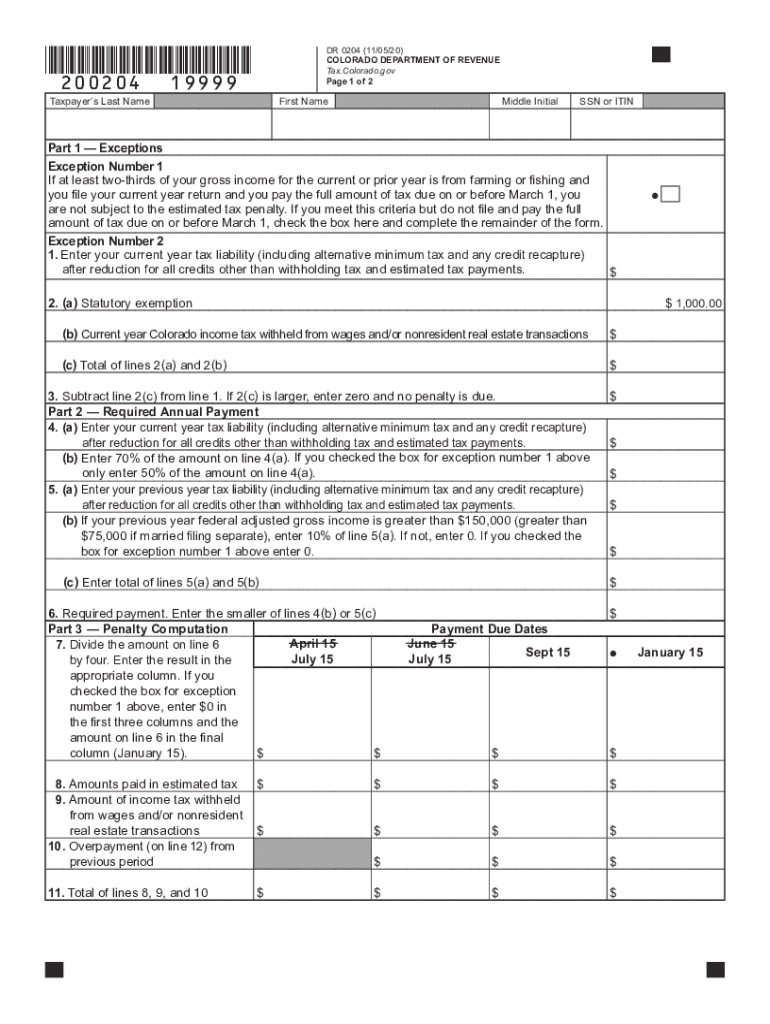

Source: www.signnow.com

Source: www.signnow.com

Dr 0204 Form Fill Out and Sign Printable PDF Template signNow, Enter your details to estimate your salary after tax. In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have.

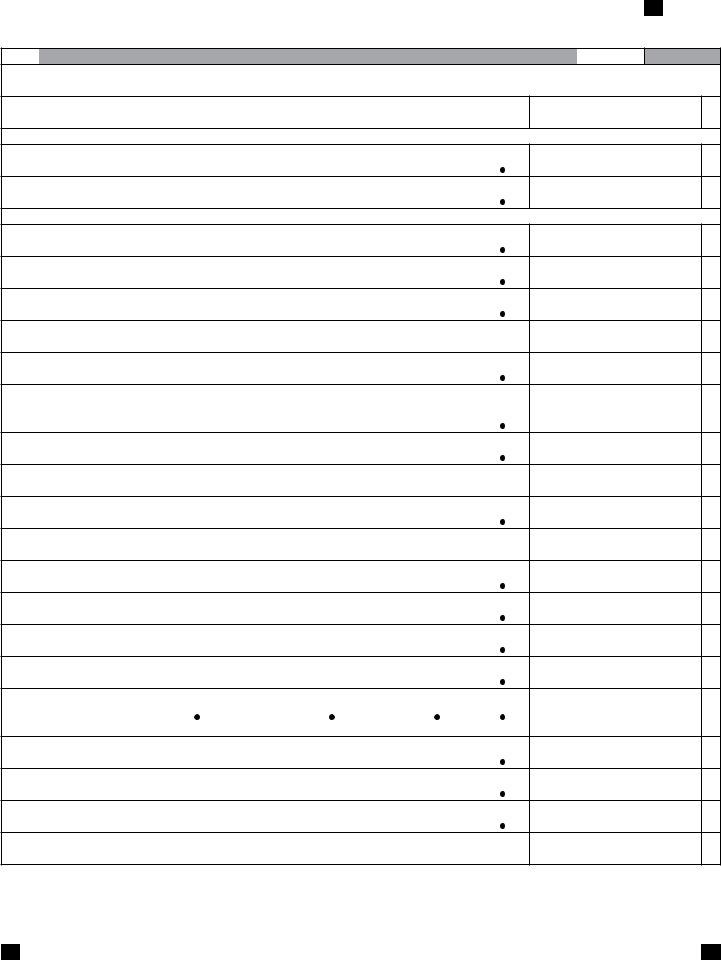

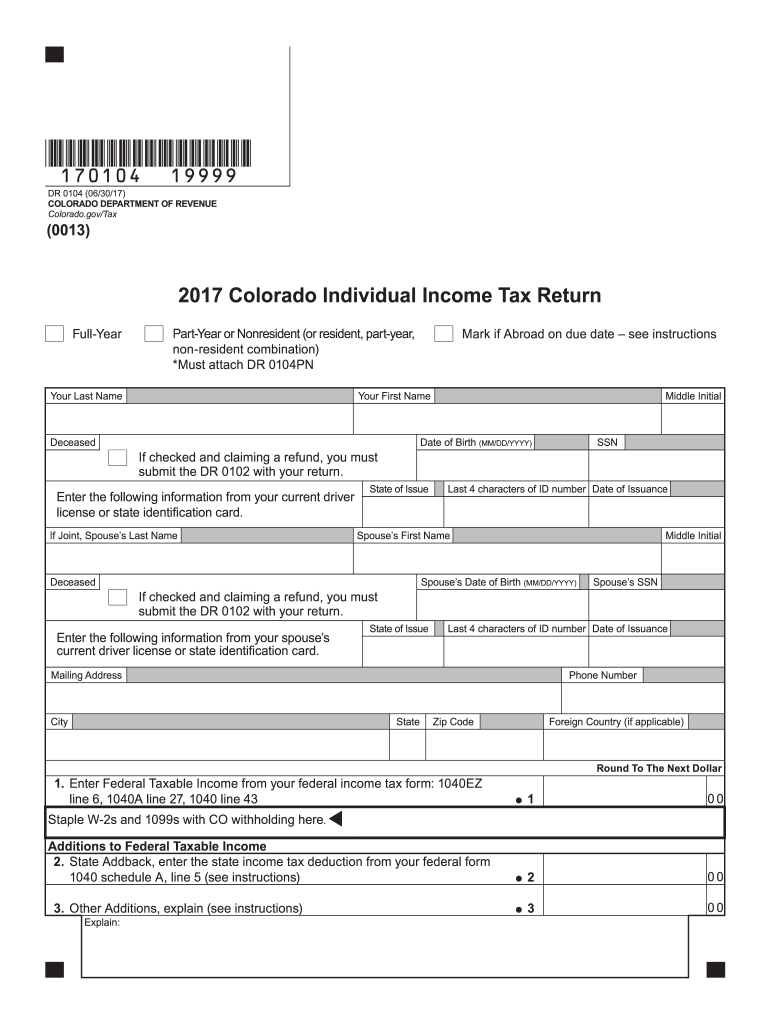

Source: formspal.com

Source: formspal.com

Colorado Tax Form ≡ Fill Out Printable PDF Forms Online, Your household income, location, filing status and number of personal exemptions. Democrats are set to unveil their colorado property tax relief plan this week.

Source: formspal.com

Source: formspal.com

Colorado Tax Form ≡ Fill Out Printable PDF Forms Online, Individuals can track their tax refund using revenue online. In general, an employer must withhold colorado income tax from all wages paid to any employee who is a colorado resident, regardless of whether the employee performed.

Source: vitoriawpenni.pages.dev

Source: vitoriawpenni.pages.dev

Tax Brackets 202425 Uk Kylen Minerva, The colorado state tax calculator (cos tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. Colorado state income tax tables in 2024.

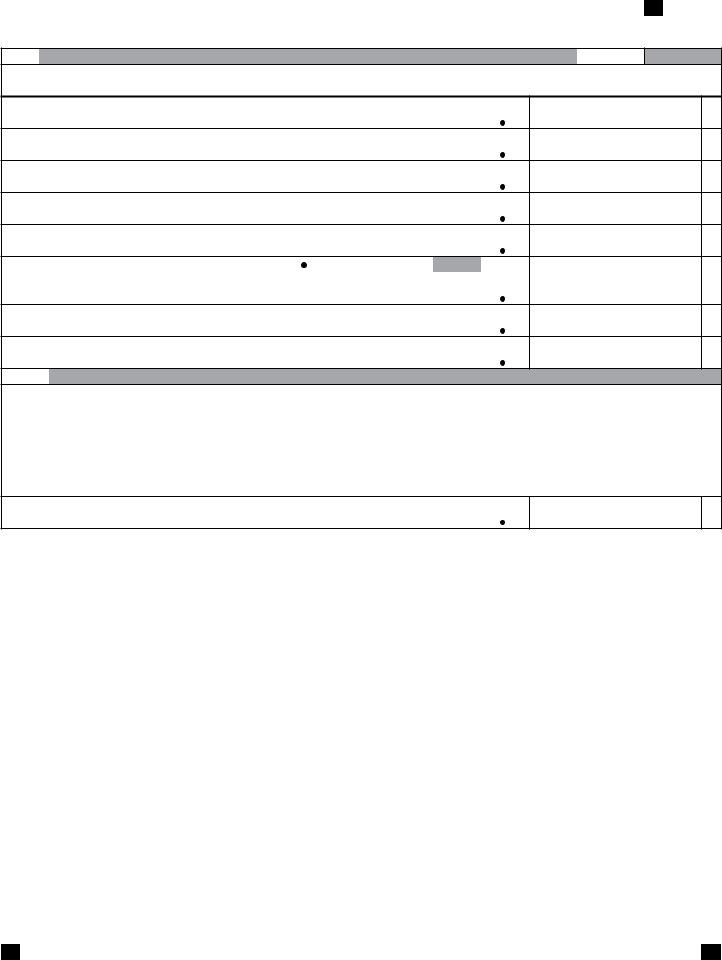

Source: www.signnow.com

Source: www.signnow.com

Colorado Form Tax Fill Out and Sign Printable PDF Template signNow, To estimate your tax return for 2024/25, please select. For tax year 2023 (taxes filed in 2024), colorado’s state income tax rate is 4.4%.

Source: coloradotaxcpa.net

Source: coloradotaxcpa.net

Colorado Tax CPA, LLC, The deadline for filing a colorado state tax return is april 15, 2024. Democrats are set to unveil their colorado property tax relief plan this week.

Source: blog.wego.com

Source: blog.wego.com

NRI Tax 2024 What is the Tax Payable for NonResident Indians, The colorado state tax calculator (cos tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. Calculate your annual take home pay in 2024 (that’s your 2024 annual salary after tax), with the annual colorado salary calculator.

Enter Your Details To Estimate Your Salary After Tax.

Colorado state income tax tables in 2024.

Colorado Has State Sales Tax Of 2.9% , And Allows Local Governments To Collect A Local Option Sales Tax Of Up.

Updated for 2024 with income tax and social security deductables.